Brian Cosgray, co-founder of DoubleNet Pay, finds it interesting that employers have gotten into the business of helping their employees with everything from health care to family leave and day care. “But on the other hand,” he says, “employers have not contributed much to helping workers to better manage their day to day finances.”

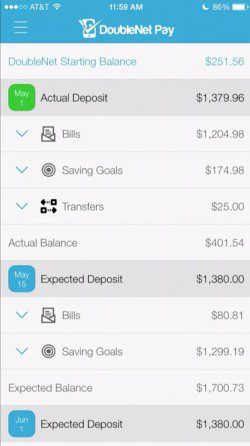

DoubleNet Pay fills that void, introducing a PFM solution that starts with payday and lets the rest of the budget almost automatically build itself. Through a partnership with ADP, DoubleNet Pay records actual take-home pay, then automatically pays whatever bills have been entered into the system. The platform allows users to set savings goals that receive automatic contributions, as well.

DoubleNet Pay co-founder Brian Cosgray demonstrated his company’s technology at FinovateSpring 2015 in San Jose.

The result, Cosgray explained, is the consumer’s “net net” pay – or double net pay: the disposable income available after regular expenses and savings are subtracted from wages. According to Cosgray, this will help consumers, especially those living “paycheck to paycheck,” avoid what he calls the “too much month at the end of the money” problem.

DoubleNet Pay was founded in December 2013 and is headquartered in Atlanta, Georgia.

How it works

How it works

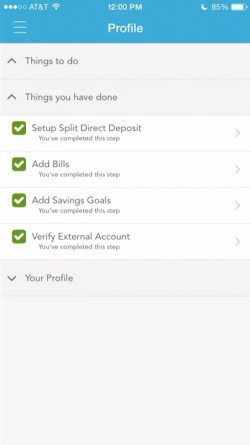

Cosgray correctly notes that one of the biggest hurdles for PFM adoption is data entry, and much of DoubleNet Pay’s functionality is designed to make the app as easy to start “as Uber.”

Users have three different ways to enter billing information. First, users can scroll through DoubleNet Pay’s set of more than 16,000 preloaded billers and simply click on their own billers in the lineup. Second, for billers not on DoubleNet Pay’s listing, users can leverage DoubleNet Pay’s partnership with another Finovate alum, Mitek, to take a photograph of the bill to extract the relevant information.

For those more informal or irregular billing situations, e.g., the babysitter or the landlord, the user can manually enter the information. For connected billers, “we automatically pull up amounts and dates due, so you never have to touch a paper statement again,” Cosgray said. Manual payees receive paper checks.

DoubleNet Pay is built to help consumers manage savings as well as spending. Users can set savings goals to set aside a pre-set amount on a regular basis. This helps users “pay themselves first.”

DoubleNet Pay is built to help consumers manage savings as well as spending. Users can set savings goals to set aside a pre-set amount on a regular basis. This helps users “pay themselves first.”

Funds can be transferred from account to account free of charge (for example, from an emergency savings account to a vacation savings account or a checking account). And users always have the ability to preview an upcoming pay period and make changes to payment dates, payment amounts, and so on before the payment goes out.

The future

Much of Cosgray’s insight into the personal finance challenges of the paycheck-to-paycheck community comes from his experience with in-house financing at a consumer goods retailer. He noticed that borrowers who paid their bills on pay day were good credit risks. Hence the idea to automate the process and build a PFM solution with pay day at the center.

“We’re working daily with employers who see the benefit of tools that automate short-term cash-flow management and savings,” Cosgray wrote in a column for Employee Benefits News last month. “Employees lead busy lives, juggling multiple work and family priorities. They need tools that make managing their daily finances and saving easier.”

Right now, DoubleNet Pay is focused on moving beyond its current partnership with ADP to work directly with payment processors, banks, and other FIs. “Our goal is to be as upstream in the flow of money as possible,” Cosgray said.

Check out DoubleNet Pay in its FinovateSpring 2015 demo video below.