Who is the most underserved community in banking? Immigrants? Millennials? People living in remote or rural areas?

According to Farhan Ahmad, CEO and co-founder of Bento for Business, the answer is: Small business.

“We are solving one of the largest unmet needs in fintech,” Ahmad said, “helping small businesses.” He says that banks want to service small businesses, but “it’s been profitable not to.” For Ahmad, whose company demonstrated its Small Business Prepaid MasterCard last month, small businesses are too important to be overlooked. “Small businesses power economics and culture,” he explained. “We want to work with banks, with service providers, and the like … to curate and build beautiful, simple and most of all useful products that are built just for small businesses.”

Bento CEO Farhan Ahmad demonstrated his card controls for small business technology at FinovateSpring 2015 in San Jose.

Small business needs are consistent around the world, but it is critical to be able to provide small businesses with the tools and resources they need in exactly the way they need them. “Every small business should build their own Bento box of financial services,” Ahmad said, comparing his company to the Japanese cuisine in which each item in a meal has its own section in a shallow box or tray. And the current product offering at the front of that Bento box is the company’s Business Prepaid Debit Cards.

Prepaid Cards from Bento provide business owners with real-time control over employee spending. Owners can set up individual employee budgets on the cards, or set them up as specific-purpose cards like gas- or travel-expense cards. Cards can be turned on or off with a single click, and the platform provides a dashboard where all of the accounts can be viewed and tracked.

Bento chose the reloadable prepaid card route so that virtually any business can be accepted, and the business owner’s credit is never affected. Ahmad makes a point of saying that while his company’s solutions can work for the tech startups of the world, they are more intended for the sorts of small businesses that don’t make headlines or dream of accessing venture capital. “We’re building a solution for the rest of the world, not just Silicon Valley,” Ahmad said.

The facts:

- Founded in January 2014 by Farhan Ahmad, CEO, and Sean Anderson, CPO

- Headquartered in San Francisco, California

- Raised $2.5 million in seed funding

- Has 8 employees

- Investors include Anthemis Group, Blumberg Capital, LionBird, and Pivot Investment Partners

How it works

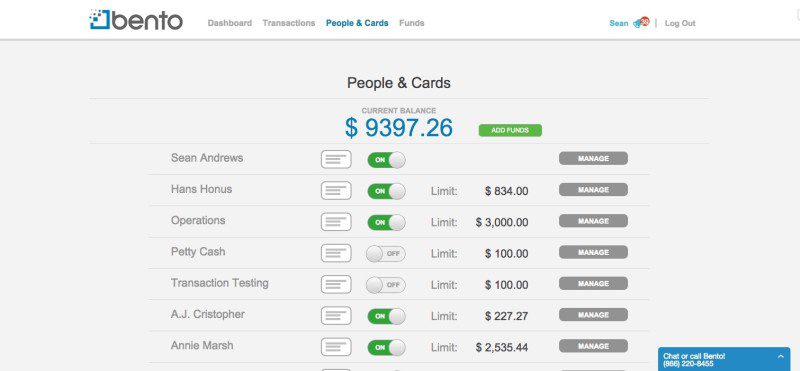

From the “People & Cards” section of the Bento Prepaid MasterCard dashboard (below), company owners can add employees and cards, as well as turn the cards on and off in real time, and set spending limits. Limits can be set by day, week or month, as well as day of the week, and owners can select locations where the card can be used.

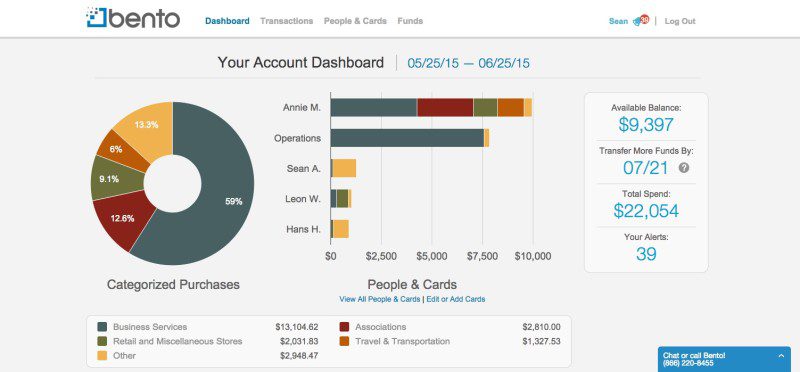

The “Account Dashboard” (below) gives the owners an overview of all accounts in a graphic form that is easy to read and easy to manage. Owners can see available balances, total spending, as well as a breakdown of purchases by category. “We give you a full picture,” Ahmad explained. “In one quick glance you can see how much money you are spending, where is it going, and who is spending how much of your money (and) where. A 3- to 5-second glance will tell you everything you need to know about your financial health.”

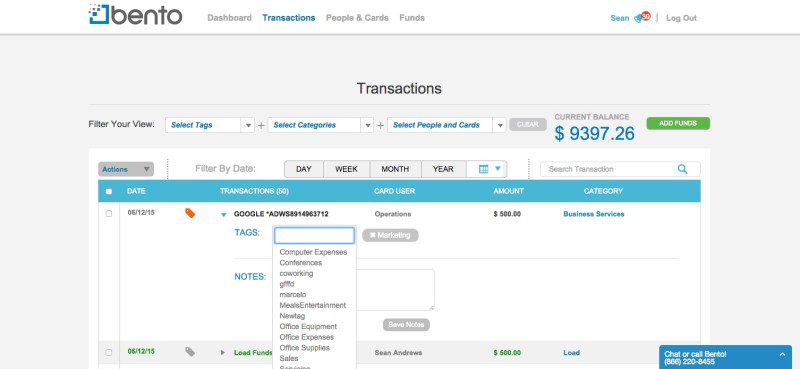

Owners can move the cursor over any of the data in the graph or table and a small dialogue bubble appears displaying the additional information about the data. Click on a data category like “Operations,” and the user is taken to the Transactions tab (below) for even more detail.

Ahmad points out that the data in the Transactions tab in the Bento platform will help business owners avoid many of the headaches that come with bookkeeping. Owners can create specific tags and leave notes for individual transactions, as well as sort, filter, and group transactions in order to build easy-to-email, print, or export reports.

Bento helps business owners spot and control the kind of small expenses that can amount to huge costs when they go unnoticed for a significant period of time. “One unauthorized cup of coffee a day from 10 employees adds up to more than $6,000 a year,” Ahmad explained. “For a regular small business that only makes $70,000 in income a year, that’s the difference between a family vacation, or not.”

The future

Ahmad has leveraged his experience working in payments at JP Morgan, Discover, and Barclays to create a platform that was “global from day one.” The idea was to build complexity in the backend, with simple controls for the end user. “Transparent and friendly” are how he describes the platform.

Bento is very much looking to partner with banks rather than to compete with them. Ideally, banks who can’t invest in the technology themselves would license the technology from Bento. At the same time, Ahmad is interested in working with companies that offer services to small businesses and even some of his fellow startup alums at Finovate looking for business-operations solutions.

Ahmad said that Bento will probably be launching another “one or two” products in 2015. But the current focus remains on marketing and getting the word out about the Bento Prepaid Commercial MasterCard. “The common thread,” Ahmad said, when asked about what to expect next from Bento, “is anything a business would need from a bank.”

Check out the FinovateSpring 2015 demo video for Bento for Business below: