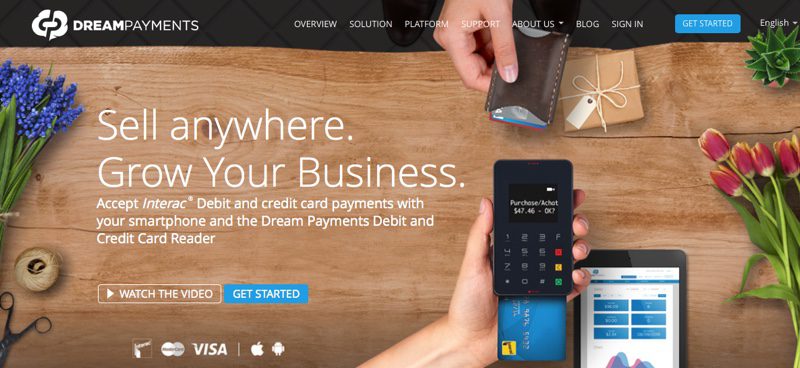

The mobile merchant services platform from Toronto-based fintech startup Dream Payments is now available to banks and merchant acquirers. The platform gives Dream Payments the ability to provide businesses with a host of services that range from mPoS apps and merchant onboarding to payment processing and business analytics.

“With Dream, banks and acquirers can finally attract and provide mobile payment services to businesses through a cloud-based, cost-effective, and flexible platform,” Dream Payments CEO Brent Ho-Young said.

Pictured (left to right): VP for Business Development Christian Ali and COO Anant Tailor demonstrated their Dream Mobile Point of Sale (mPOS) solution at FinovateSpring 2015.

Dream Payments launched its mPoS service for merchants last year. With this move, the company shows its cloud-based platform as an option for banks and acquirers to help their customers transition from legacy systems to EMV and mPoS technology.

The company this week presented its technology at the Mobile World Congress Conference in Barcelona, Spain. The platform includes:

- white-label, pre-built, iOS and Android apps for payments, receipts, product catalogs, and real-time analytics

- support for EMV contact and contactless mobile payment terminals

- retail distribution and remote activation capability

- third party SDK

Founded in 2014 in Toronto, Ontario, Canada, Dream Payments demonstrated its mPOS solution at FinovateSpring 2015. The company, which raised $6 million in funding last spring, launched Canada’s first retail EMV mPOS terminal that accepts Interac debit card payments in October. Read our summer 2015 profile of Dream Payments.