Move over robo-advisers and alternative lenders, there’s a new destination for investment dollars in the fintech space.

Digital insurance-comparison and -shopping platform CoverHound announced today that it closed a $33.3 million Series C round. The investment takes the company’s total funding to more than $53 million, giving CoverHound a valuation of more than $100 million.

The round was led by ACE Group and featured participation by existing investors, American Family Ventures, Blumberg Capital, Core Innovation Capital, Route 66 Ventures, and RRE Ventures.

The round was led by ACE Group and featured participation by existing investors, American Family Ventures, Blumberg Capital, Core Innovation Capital, Route 66 Ventures, and RRE Ventures.

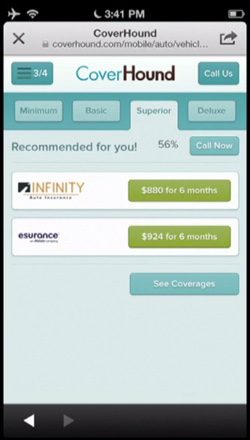

CoverHound CEO Keith Moore emphasized his company’s commitment to the comparison-shopping model as the “fastest and smartest way” for consumers to buy property and casualty (P&C) insurance. The company plans to use the capital to invest in new talent, specifically in product management and engineering, as well as new products for SMEs and entrepreneurs. CoverHound also plans to emphasize adding insurance carriers to its platform and finding partnerships in new states.

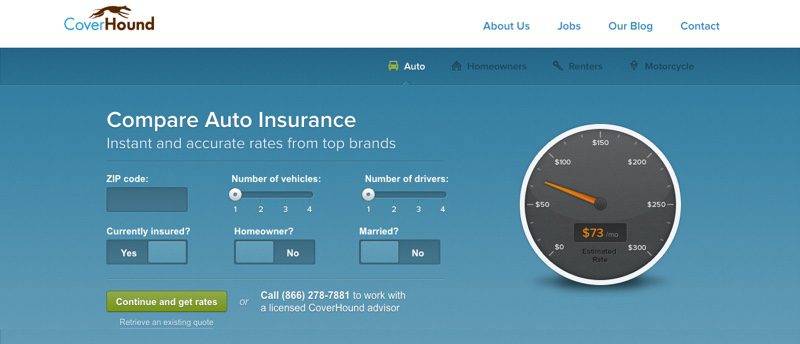

2015 has been a banner year in funding for CoverHound. This spring, the company announced a successful $14 million Series B round that included news of its Google Compare partnership. CoverHound currently provides auto, homeowners, renters, and motorcycle insurance from more than 20 carriers including Progressive, Safeco, Travelers, and MetLife. The company says it has experienced new customer policy growth of more than 168% in 2015.

As part of the investment, James D. Robinson III, RRE Ventures’ co-founder and general partner, will join the CoverHound board. Robinson was CEO of American Express from 1977 to his retirement in 1993.

Founded in May 2010 and headquartered in San Francisco, California, CoverHound demonstrated its technology at FinovateFall 2013 in New York.