Volatility in cryptocurrency markets continues to spell opportunity for digital asset trading platform and cryptocurrency exchange Coinbase. The company announced on Friday that it was launching a new venture fund called Coinbase Ventures to support crypto-based startups.

“We’ll be providing financing to promising early stage companies that have the teams and ideas that can move the space forward in a positive, meaningful way,” wrote Coinbase Head of Corporate and Business Development and Business Operations Emilie Choi at the Coinbase blog. “At least in the beginning, our goal is simply to help the most compelling companies in the space to flourish. This means that we don’t have the strategic requirement of formalizing partner relationships with such companies, as some corporate venture programs do,” Choi explained. “Our focus is on building strong relationships and helping to spur on the development of the ecosystem.”

Interestingly, Choi added that some of Coinbase Ventures’ investments may be “in companies that ostensibly look competitive with Coinbase.” By way of explanation, Choi said Coinbase was “comfortable” investing in potential competitors because “we’re taking a long term view of the space, and we believe that multiple approaches are healthy and good.”

The launch of Coinbase Ventures comes amid a flurry of activity for the cryptocurrency exchange platform. A month ago this week Coinbase unveiled its Coinbase Index and Coinbase Index Fund, a market cap weighted index and related fund that provide investors with exposure to all the digital assets available on its GDAX exchange. More recently, Coinbase made available new tax tools to help cryptocurrency investors and traders comply with IRS guidelines as they relate to reporting gains from digital asset transactions.

Additionally, Coinbase announced support for the withdrawal of Bitcoin forks across its products “in the coming months”. The decision will make it easier for customers to withdraw assets associated with Bitcoin Forks, though Coinbase noted that supporting withdrawal for a bitcoin fork does not mean the asset will be available for trading on the platform. “Assets that are listed for trading will be independently evaluated using the Digital Asset Framework,” according to a post at the Coinbase blog. The company hopes that the simultaneous internal and external announcement would help it avoid the controversy surrounding the trading of Bitcoin cash last December.

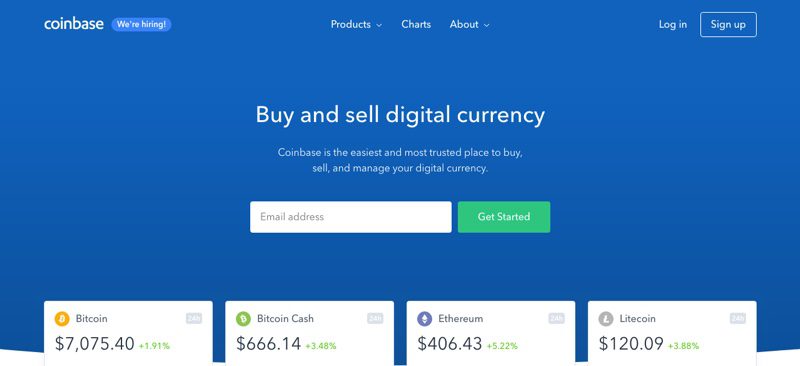

Founded in 2012 and headquartered in San Francisco, California, Coinbase demonstrated its platform at FinovateSpring 2014. The company, which has raised more than $225 million in funding, launched its crypto eCommerce acceptance platform, Coinbase Commerce in February, and began the year with the acquisition of the engineering team from Memo.AI. Named to the Forbes Fintech 50 for the second year in a row earlier this year, Coinbase earned unicorn status last August after closing a $100 million Series D round that boosted the company’s valuation to an estimated $1.6 billion. Founder Brian Armstrong is Coinbase’s CEO.