Machine learning algorithm specialist Ayasdi has raised $55 million in a new investment that doubles the company’s total capital.

The Series C round was led by Kleiner Perkins Caufield & Byers (KPCB), and featured participation from existing investors Citi Ventures, FLOODGATE, Institutional Venture Partners (IVP), and Khosla Ventures. New investors Centerview Capital Technology and Draper Nexus were also part of the investment, which takes Ayasdi’s total funding to more than $100 million.

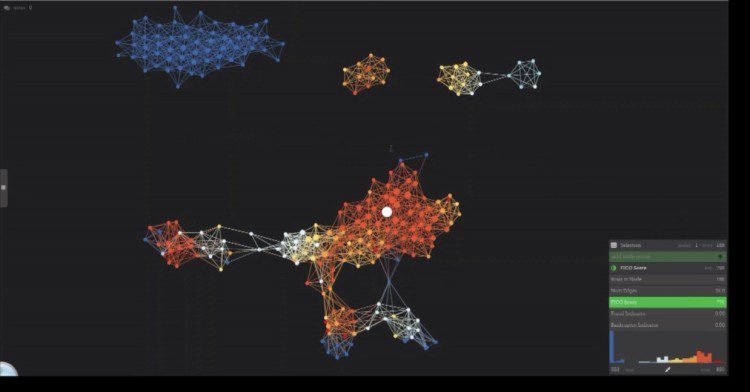

Ted Schlein of KPCB praised Ayasdi’s ability to make complex data analysis easier for large institutions and organizations. He cited the technology’s combination of “machine learning algorithms with topological mathematics and artificial intelligence” as a “breakthrough innovation that will drive the next information and productivity wave in the coming decade.”

Health care systems have been among the most eager adopters of the Ayasdi’s technology. But the company is working with three of the five largest financial institutions in the world to help them make smarter lending decisions, improve risk and compliance modeling, protect against fraud, and better serve private banking clients. Deborah Hopkins, Chief Innovation Officer of Citi and CEO of Citi Ventures said the technology provided insights that “enable Citi to tailor services to specific client needs, operate more efficiently, and mitigate risk.”

Learn more about Ayasdi from our November feature. The company’s CEO Gurjeet Singh has been profiled frequently in major media from Forbes to TechCrunch, as Ayasdi has forged partnerships with companies like Teradata and Cloudera to make its technology even more valuable to enterprise-level clients. In February, the company was named one of the 10 most innovative companies in Big Data by Fast Company for a second year in a row.

Founded in 2008 and headquartered in Menlo Park, California, Ayasdi made its Finovate Debut in New York at FinovateFall 2014. See video of the company’s live demonstration of Ayasdi Finance.