In a round led by General Atlantic, and featuring participation from current investors S3 Ventures and Argonaut Private Equity, digital banking solutions provider Alkami has raised $70 million in new funding. The Series D round, which represents a strategic investment in the company, takes Alkami’s total capital to more than $116 million.

“In an era of digital transformation, our clients, who consist of credit unions and banks in the U.S., count on Alkami to inspire and power their digital strategies through enhancing value, growth, service, efficiency and relationships,” Alkami CEO Mike Hansen said. He added that the strategic investment from General Atlantic will “accelerate the delivery of our world-class technology and innovative solutions to our clients, ensuring Alkami remains synonymous with digital transformation in finance.”

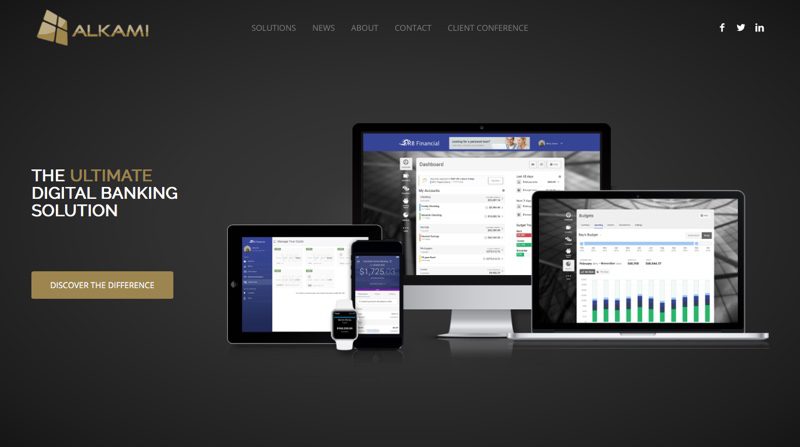

Alkami enables financial institutions to take advantage of the latest trends in online and mobile banking technology through its cloud-based digital banking platform. With more than 4.5 million users across its community bank and credit union client base, Alkami provides a unified solution that works across devices and channels to deliver retail and business banking services, billpay, PFM, marketing, and more.

As part of the strategic investment, Raph Osnoss and Gene Lockhart will join Alkami’s board of directors. Lockhart is a Special Advisor of General Atlantic and former President and CEO of MasterCard Worldwide. He is also Chairman and Managing Partner of MissionOG, a technology investor that also participated in Alkami’s Series D. Osnoss is Vice President of General Atlantic, and praised Alkami’s “vision, technology, client success, and business model” as well as the way the fintech helped FIs better engage with their customers.

“Digital banking needs are evolving along with consumer and business behaviors,” Osnoss said. “And we believe Alkami is at the center of this industry-wide shift.”

Plano, Texas-based Alkami made its first Finovate appearance in 2009 as iThryv. In November, the company was highlighted as the 13th fastest growing company in Dallas by Southern Methodist University’s Cox Dallas 100 and ranked 66th fastest growing company in North America by Deloitte’s 2017 Technology Fast 500. Alkami announced a deployment of its digital banking platform with Veridian Credit Union ($3.4 billion in assets) late last fall, and in August, the company inked a deal with Mountain America Credit Union ($6.7 billion in assets) to integrate its digital banking technology with Mountain America’s existing core system.