Accounts receivable and debt collection management company collectAI made inroads into the U.K. this week.

The expansion is made possible via a partnership with Pay360 by Capita, which will build a branded receivables management solution for its business and government clients around collectAI’s technology.

Stephen Ferry, managing director at Pay360, said, “By working with strategic partners such as collectAI, we’re able to deliver a smarter, more efficient receivables process, that’s in line with today’s smartphone generation. Coupled with our ability to settle outstanding payments via the U.K.’s most popular payment methods, we’re edging towards an era of smart payments based on the needs and behaviour of the end consumer.”

Operating as a subsidiary of Germany’s largest ecommerce retailer Otto Group, collectAI launched in 2016 and now has $50 million (€40 million) in receivables under management. This is $6 million higher than the company’s October 2017 milestone of $31 million (€25 million). Pay360 is the third company collectAI has partnered with to offer its white label debt collection technology. collectAI has also partnered with an additional 20 medium and large businesses to pursue the collection of debt on their behalf.

As its name suggests, the Germany-based company leverages artificial intelligence and machine learning to improve the debt collection process. The technology engages consumers via their preferred digital channel and allows them to settle debt using their favorite payment method. The implementation of these enabling technologies not only makes for a better end user experience, it also relies less heavily on human labor, offering a cost reduction.

Describing the technology, Steve Emecz, CCO of collectAI, said that the company brings receivables into the digital age. “Our technology provides access to all digital communication channels and ensures frictionless payments. As a result, faster execution and higher repayment rates improve the consumer experience and boost customer retention. AI isn’t the future, it’s the now.”

Mirko Krauel, collect.AI CEO, demoed the company’s claims management technology at FinovateEurope 2017. To date, the company has improved the collection rate to 33% on average with a 41% reduction of processing costs.

Presenters

Presenters Quentin Colmant, Co-founder

Quentin Colmant, Co-founder

Presenters

Presenters

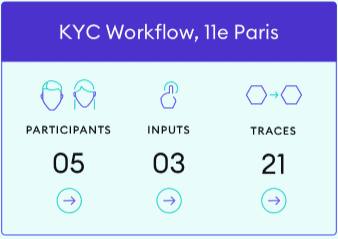

Dubbed IndigoTrace, it’s a user-friendly API that allows business administrators to create a workflow and invite participants, giving them each a role designated by a public/private key. Users can add inputs to the workflow and all changes can be monitored and traced in real time. This traceability offers visibility into who did what, when, where, and why, allowing for easy audits throughout the process. All information is secured by Stratumn’s Proof of Process (PoP) technology and public blockchains.

Dubbed IndigoTrace, it’s a user-friendly API that allows business administrators to create a workflow and invite participants, giving them each a role designated by a public/private key. Users can add inputs to the workflow and all changes can be monitored and traced in real time. This traceability offers visibility into who did what, when, where, and why, allowing for easy audits throughout the process. All information is secured by Stratumn’s Proof of Process (PoP) technology and public blockchains.

Presenters

Presenters Vitor Barros, Pre-Sales Director

Vitor Barros, Pre-Sales Director