We recently chatted with the team at PayNearMe, maker of the electronic cash transaction network, about how banks can benefit from its new offering.

Company overview:

- Headquarters: Sunnyvale, CA

- Founded: 2009

- Total funding: $34.4 million

- Notable contributors: August Capital, Fenwick & West, Khosla Ventures, and True Ventures

- Demos: FinovateFall 2010 (Best of Show Winner), FinovateSpring 2011 (Best of Show Winner), FinovateFall 2011, FinovateSpring 2013 (Best of Show Winner)

What is PayNearMe?

PayNearMe helps consumers who prefer to pay with cash, a market estimated to be somewhere between 60 and 100 million Americans whose cash transactions total $1.3 trillion each year. Previously, cash users had been pretty much shut out of the ecommerce world.

PayNearMe’s technology solves this by giving consumers the option to pay with cash remotely in brick-and-mortar stores around the country. It currently accepts cash at just under 10,000 7-Eleven and Ace Cash Express locations. Check out our experience using the technology.

Merchant Examples:

- Service providers, such as Greyhound, who sell tickets online (see example in video below).

- Billing service providers, such as Infosend

- Landlords and property management companies, such as Aclara Realty (see example in video below)

How can banks benefit?

PayNearMe can help banks manage cash receivables for corporate Treasury Management accounts. This allows banks to act as funds managers, but reduces their need to deal with the retail management side of handling cash.

From the end consumers’ perspective, this works a bit like a remote deposit capture solution that deposits cash instead of a check. Unlike traditional remote deposit capture for checks, it requires consumers to surrender their cash at the nearest 7-Eleven or Ace Cash Express.

While this won’t fully replace all foot traffic into bank branches, it has potential to mitigate the burden and cost of extra cash deposits and payments inside bank branches, especially in lower income neighborhoods where some banks have been closing their branch doors, as seen in this Bloomberg Businessweek piece.

In the end, PayNearMe has the potential to help banks reduce branch costs and/or locations.

Use cases

The cash management side of PayNearMe is well-suited for industries such as property management (think rent payments), and government (think court fees and parking tickets) where a lot of small cash receivables are handled and processed. Because some consumers still need to pay in cash, it removes the hassle of travelling to the bank or a payment window that manages the receivables.

Here are two real-life examples:

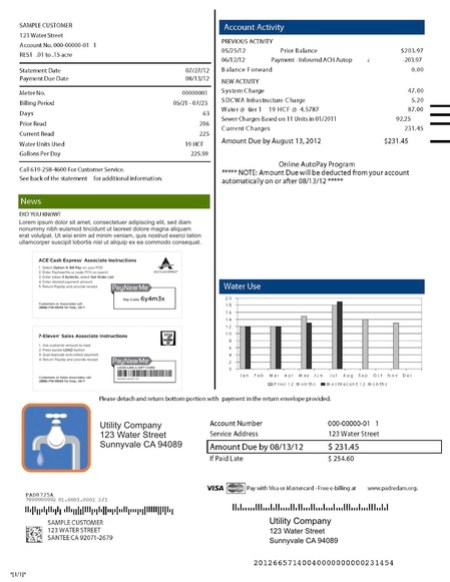

1) Water bill payment

2) Armand Dupree (owned by Tupperware)

Cosmetics company Armand Dupree has a team of in-home salespeople, many of whom are underbanked. Because the end customers are also typically underbanked, payments are generally collected in cash. The salespeople can essentially remotely deposit cash by using 7-Eleven and Ace Cash Express stores as cash depositories. This can extend the bank’s reach without adding new brick-and-mortar expenses.

What’s next:

During the next 8 or 9 months, PayNearMe plans to add new retailers that would triple the number of locations where it accepts cash. If all goes according to plan, this time next year the company will have more than 25,000 access points, compared to the just under 10,000 today.

Sample question 2 (honesty assessment):

Sample question 2 (honesty assessment): Sample question 3 (business intelligence assessment):

Sample question 3 (business intelligence assessment): From the bank’s perspective

From the bank’s perspective